Newswise — The future promises big advances in machine learning and artificial intelligence, and corporate America is once again eyeing nuclear energy. The interest reflects a growing awareness on Wall Street and in Silicon Valley that nuclear could be the best way to get consistent, carbon-free electricity to energy-hungry data centers.

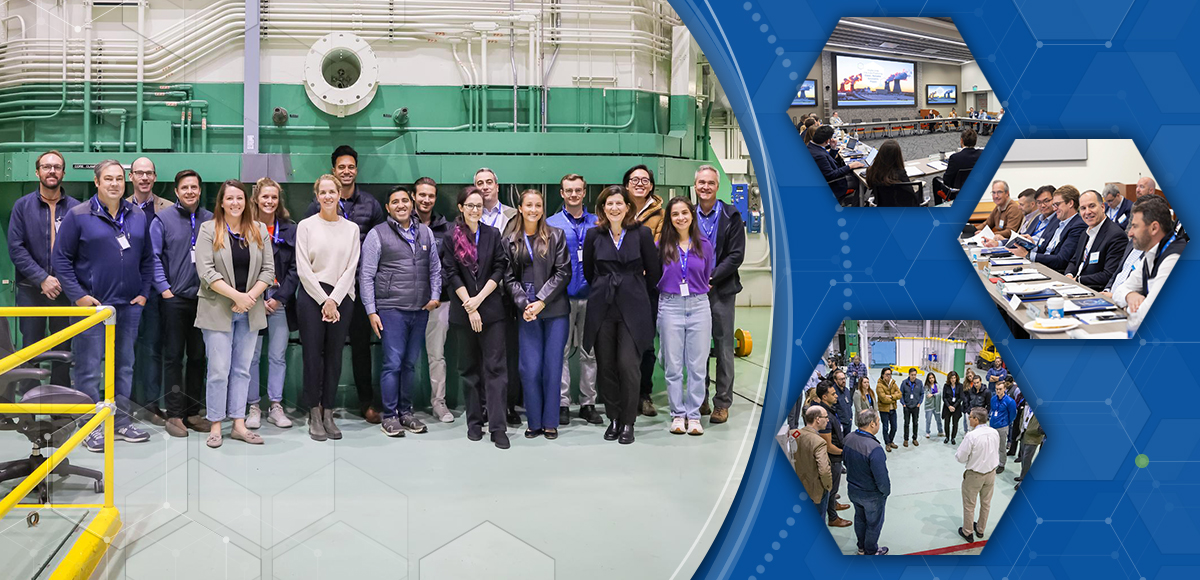

Representatives from such multibillion-dollar companies as Meta (Facebook), Amazon and Google came to Idaho National Laboratory in mid-October for Nuclear Investor Days, co-hosted by the lab and the U.S. Department of Energy. Bankers and advisers from Goldman Sachs, Morgan Stanley and BlackRock also attended the event. The 26 participants represented more than $1 trillion in investment dollars.

“This is a great time to have this event here,” said Michael Goff, acting assistant secretary of DOE’s Office of Nuclear Energy. That same week, Amazon and Energy Northwest announced they were spending $500 million on a small modular reactor project near the Columbia Generating Station in Washington. Further, Google announced it was signing the world’s first corporate agreement to purchase power from SMRs developed by Kairos Power. And DOE announced it was opening applications for up to $900 million to support initial domestic deployment of SMRs.

Energy demand projections have prompted the reopening of the Palisades Nuclear Generating Station in Michigan. Microsoft has announced a deal to restart Three Mile Island Unit 1 at Constellation Energy’s Crane Clean Energy Center. “I never thought we would be talking about restarting plants,” said Goff, a nuclear industry veteran of 40-plus years.

In addition to presentations and discussions on such topics as risk management, supply chains and converting old coal plant sites to nuclear for new capacity, the group toured INL’s Advanced Test Reactor and Materials and Fuels Complex and visited Experimental Breeder Reactor-1, where electricity from nuclear power was first generated in 1951.

For decades, the United States led the world in the development of nuclear energy, said INL Director John Wagner. “We know how to do this, and I absolutely believe we can do it again,” he said.

Four things caused new nuclear projects to stall in the United States in the early 1980s: declining demand for energy, double-digit interest rates, cheap natural gas and poor public perception. Things have changed dramatically with public perception. A Pew Research Center survey from May indicated that 56 percent of Americans said they favor more nuclear power plants to generate electricity.

“Public perception is now at an all-time high, and has been stable for the last few years,” Wagner said. “In my career, I’ve never seen such strong positive public perception.”

That leaves the issue of money. Nuclear plants are expensive and take a long time to build. The United States still produces more electricity from nuclear energy than any other country using 55 power stations built mostly between the mid-60s and the early 90s. But over the last 20 years, several plants have shut down, mainly for economic reasons. Only three new reactors have been built since the 1990s, and the delays and cost overruns at the Vogtle Electric Generating Plant in Georgia, where Units 3 and 4 went online in 2023 and 2024, have made investors wary.

DOE can help, said David Crane, DOE’s undersecretary for infrastructure. The Inflation Reduction Act of 2022 was the first piece of major federal legislation to recognize nuclear energy as a carbon-free source, placing it on the same level as renewable energy sources. Before the act, renewable energy sources like solar and wind received significant benefits from federal incentives, but nuclear did not.

The $250 billion Energy Infrastructure Reinvestment program supports retooling, repowering, repurposing or replacing plants that have ceased operation. It also supports energy operations that cut pollution or greenhouse gas emissions. In either case, it makes low-cost, long-term loans available to eligible applicants.

Discussion also focused on the Nuclear Regulatory Commission, which under the bipartisan ADVANCE Act of 2024, has been ordered to make its license application review process more efficient, timely and predictable. ADVANCE — which stands for Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy — also calls for changes to how the agency recovers fees from licensees.

The United States is one of 25 countries that pledged at the end of 2023 to triple nuclear capacity by 2050. The declaration, signed at the World Climate Action Summit (COP28), invited shareholders of international financial institutions to encourage the inclusion of nuclear energy in energy lending policies.

Crane spent 15 years in the private sector, including 12 years as CEO of NRG Energy, where he guided the development of clean energy assets with a capacity of more than 2.5 gigawatts. An early booster of solar energy, he recounted how expensive it was in 2006 compared to what it costs now. “We want to duplicate the success of the solar industry, but do it faster,” he said.

Nuclear is more complicated than solar, Crane said. “The barriers to entry are large,” he said. “We’re here to demystify nuclear. We’re not here to tell you it’s not complex.”

Being a first mover can have its advantages, but with any first-of-a-kind technology managing risk is always going to be a challenge, he said.

Events for potential investors like the one held at INL are critical to cutting carbon emissions and meeting net-zero goals. “The fact that they’re coming here to learn and coming here to understand the risk is a big deal,” Crane said. “We can’t run away from things that are complex when they’re needed.”